India’s No. 1 Online Admission Portal Apply Now

India’s No. 1 Online Admission Portal Apply Now

Students Pursuing Higher Education in India and Abroad don’t have to struggle hard anymore to finance their Studies. Now many banks in India are providing Education loans in a scale never happened before.

CareerMarg is tied up with Credila for students loans

Ideally, take a loan from a bank located at your place of study than one located where you reside, unless it concerns overseas studies. This is because you will have better access to funds if you take a loan from the place of your study. Secondly, Make sure the repayment period starts only after six to twelve months after you begin your working life. And thirdly, Banks typically prefer to finance students who opt for traditional courses.

Management students are among the top choices for most of the banks. Technology students from the country’s premier institutions can also get student loans from Banks and Medical and engineering college students. Banks don’t provide loans for students with a bachelor’s/master’s in Arts. Also, for courses where employment prospects are less (as per Bank’s own evaluation), loans are sanctioned on the basis of the parents’ income.

How many loans you can get?

Loan for Studies in India Most of the Public Sector Banks in India have categorized Student Loans in two categories. For Studies in India, Students can borrow up to Rs 4 lakh without providing any security or margin. A loan amount of Rs 4 lakhs to Rs 7.5 lakhs can be availed against a third-party guarantee. This loan comes with a five per cent margin (what this means is that you will get five per cent less the amount sanctioned as a loan; you will have to put together the rest of the money). The third-party guarantee can come from an uncle, neighbour or friend standing guarantee for the full amount.

Overseas study loans: Amounts worth Rs 7 lakhs and above are usually sanctioned against fixed deposits, NSC certificates, property worth the loan amount and a margin amount of 15 per cent (what this means, again, is that you will get 15 per cent less the amount sanctioned as a loan; you will have to put together the rest of the money). Also, if a loan below Rs 4 lakhs comes at x rate of interest, the loan over Rs 4 lakhs is usually charged one per cent higher interest. The Reserve Bank of India prescribes the specifics (amount, rate, repayment period) of education loans and the government provides a two per cent subsidy on these loans to the banks.

Repayment – Course period + 1 year or 6 months after getting a job, whichever is earlier.

All students are required to submit mark sheets of last qualifying examination, proof of admission scholarship, schedule of expenses for the specified course, his/her bank account statement for the last six months, an income tax assessment order for the previous two years, a brief statement of assets and liabilities, of the co-borrower, which is usually the parent or guardian and proof of income, if any.

Some banks require all or any of the following documents as pre-sanction documents: To furnish the following documents along with the completed application form.

Relevant information would relate to the guardian and the student both when the loan is jointly taken.

1)Mark sheet of last qualifying examination for school and graduate studies in India

2)Proof of admission to the course

3)Schedule of expenses for the course

4)Copies of letter confirming scholarship, etc.

5)Copies of foreign exchange permit, if applicable.

6) 2 passport size photographs

7) Statement of Bank accounts for the last six months of borrower.

8.) Income tax assessment order not more than 2 years old

9) A brief statement of assets and liabilities of the borrower.

10)If you are not an existing bank customer you would also need to establish your identity and give proof of residence.

The applicant should be an India National

The applicant must have secured admission to professional/ technical courses through Entrance Test/ Selection process

Secured admission to foreign university/ Institution

Most of the Private Sector banks, Foreign Banks and Public Sector Banks in India are providing Student Loans. Below given are some of the main banks which have flexible Education loan schemes.

|

Andhra Bank

|

Allahabad Bank

|

Axis Bank

|

|---|---|---|

|

Bank of Baroda

|

Bank Of India

|

Bank of Maharashtra

|

|

Bank of Punjab

|

Bank of Rajasthan

|

Bassein Catholic Bank

|

|

Bharat Overseas Bank

|

Canara Bank

|

Catholic Syrian Bank

|

|

Central Bank of India

|

Centurion Bank of Punjab

|

Citi Bank

|

|

City Union Bank

|

Corporation Bank

|

Dena Bank

|

|

Development Credit Bank

|

Dhanalakshmi Bank

|

Federal Bank

|

|

HDFC Bank

|

HSBC

|

ICICI Bank

|

|

Indian Bank

|

Indian Overseas Bank

|

IDBI Bank

|

|

ING Vysya Bank

|

Jammu & Kashmir Bank

|

Karnataka Bank

|

|

Karur Vyasa Bank

|

Lakshmi Vilas Bank

|

Oriental Bank of Commerce

|

|

Punjab & Sind Bank

|

Punjab National Bank

|

Ratnakar Bank

|

|

Saraswat Bank

|

SBI Commercial and International Bank

|

South Indian Bank

|

|

State Bank of Bikaner & Jaipur

|

State Bank of Hyderabad

|

State Bank of India (SBI)

|

|

State Bank of Indore

|

State Bank of Mysore

|

State Bank of Patiala

|

|

State Bank of Saurashtra

|

State Bank of Travancore

|

Syndicate Bank

|

|

Tamilnad Mercantile Bank Ltd

|

Thane Janata Sahakari Bank

|

UCO Bank

|

|

Union Bank of India

|

United Bank of India

|

United Western Bank

|

No Comments Found

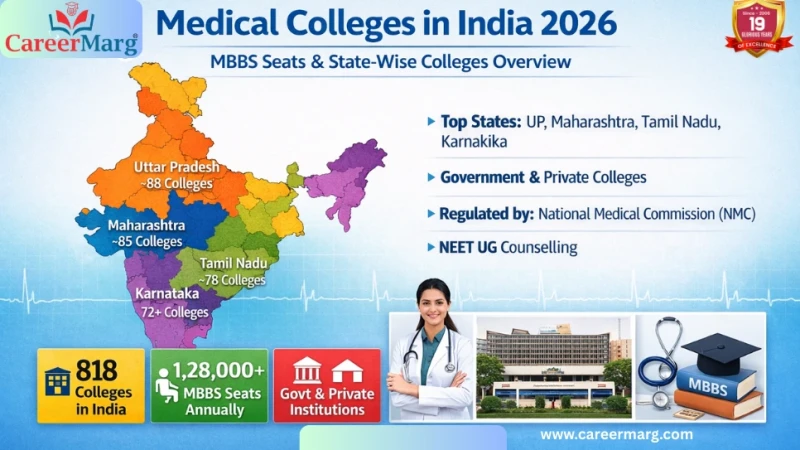

India has approximately 818 medical colleges with over 1.28 lakh MBBS seats available annually through NEET UG counselling in 2026, according to the latest government update presented to Parliament. This expansion has improved accessibility to medical education and increased opportunities for NEET aspirants....

MBBS in Nepal is a popular choice for Indian students seeking affordable and NMC-approved medical education abroad. The total cost of MBBS in Nepal ranges between ₹45–75 lakhs depending on the college. Admission requires NEET qualification, and the course duration is....

Studying MBBS abroad has become one of the most popular options for Indian students who want to pursue a medical career but face intense competition and high tuition fees in India. Every year, thousands of NEET-qualified students choose MBBS abroad....

Explore the MBBS in Nepal 2026 seat matrix with complete college-wise seat distribution, foreign quota details for Indian students, eligibility criteria, fees, and admission process. Get accurate and updated guidance from CareerMarg for securing your medical seat in Nepal.Complete College-Wise....

NEET UG 2026: Important Dates (Official)EventDateApplication Start Date08 February 2026Last Date to Apply08 March 2026 (up to 9:00 PM)Last Date for Fee Payment08 March 2026 (up to 11:50 PM)Correction Window10 March – 12 March 2026NEET UG 2026 Exam Date03 May 2026Exam Timing02:00 PM – 05:00 PM (IST....