India’s No. 1 Online Admission Portal Apply Now

India’s No. 1 Online Admission Portal Apply Now

The Bihar Student Credit Card Scheme (BSCC) is one of the most important Bihar government schemes for students after 12th. It provides an education loan of up to ₹4 lakh to help students pursue engineering, diploma, B.Tech, MBBS, nursing, BBA, MBA, law, paramedical, and many other professional courses.

If you’re searching for “what the Bihar Student Credit Card scheme is,” how to get the ₹4 lakh student loan in Bihar, or whether the BSCC provides a free higher-education loan, this guide explains everything clearly and simply.

Bihar Student Credit Card (BSCC) is a higher-education financial support scheme launched under the Mukhyamantri Nishchay Yojana. Its aim is to help students from Bihar who want to study professional or higher education courses but cannot afford the rising cost of college fees.

Many students look online to understand the scheme—whether it is a government-backed student loan, how the ₹4 lakh BSCC loan works, or whether the scheme truly helps students after 12th. The BSCC is designed exactly for these concerns.

In simple words, it provides an education loan of up to ₹4 lakh with very low or subsidized interest, helping students pursue engineering, medical, management, law, paramedical, and other approved courses without financial pressure.

The scheme offers multiple advantages that make higher education more accessible and affordable for Bihar students. Here are the key features:

Students can get a loan of up to ₹4 lakh for approved undergraduate and professional courses. This amount helps cover major academic expenses without financial stress.

The loan can be used to pay:

This ensures complete financial support throughout the course.

A major benefit of BSCC is the interest subsidy provided by the government. For many students, the effective interest becomes very low—and sometimes almost zero—making it feel like a free education loan in Bihar.

Applications are made through the 7 Nischay / MNSSBY portal, which ensures transparency. The portal guides students through registration, form submission, and document upload.

Dedicated District Registration and Counselling Centres (DRCCs) provide:

This support system helps students apply smoothly without confusion.

The scheme supports almost all major higher-education programs, including:

Students from science, commerce, arts, and vocational backgrounds can all benefit from BSCC.

To apply for the scheme, students must meet certain eligibility requirements related to residence, academic qualification, admission status, and basic financial background. These criteria ensure that support reaches students who genuinely need financial assistance for higher education.

The scheme supports a wide range of higher-education courses to accommodate students from science, commerce, arts, and professional backgrounds. Listed below are the major categories of courses eligible under the loan.

These options make the scheme ideal for students pursuing technical and engineering education.

These programmes are suitable for students interested in business, finance, and corporate careers.

This makes the scheme highly valuable for medical and healthcare-focused students.

These course options ensure that students from all academic streams can benefit from the scheme.

The scheme provides students with a loan of up to ₹4 lakh for approved courses. This amount is designed to cover essential educational expenses such as tuition fees, hostel charges, admission fees, books, study materials and other academic requirements.

One of the biggest benefits of the scheme is the interest subsidy provided by the Bihar government.

For many student categories—including girls, transgender students, and special-category applicants—the effective interest rate becomes extremely low and sometimes almost zero.

Repayment begins only after the student completes the course and gets additional relaxation time. The EMI structure is designed to avoid any financial stress during studies.

Students must keep their academic, identity and residence documents ready during the online application, as well as at the time of DRCC verification.

The entire application process is online through the official 7 Nischay / MNSSBY portal.

Students can track their application status online at any time:

The scheme supports students enrolled in a wide range of professional courses:

Many students face issues during the Bihar Student Credit Card application process due to incomplete documents, eligibility mismatches, or mistakes in the online form. Delays can also occur at the DRCC or bank level if verification is pending or if the college has not confirmed fee details. Understanding the common problems and rejection reasons helps students avoid errors and ensures a smoother approval process.

If a student discontinues the course:

For help, students can contact:

Q1. How much loan can I get under the Bihar Student Credit Card scheme after 12th?

Students can get a loan of up to ₹4,00,000 (4 lakh) for approved higher-education and professional courses. The amount covers tuition fees, hostel charges, books, exam fees, and other essential academic expenses.

Q2. Which bank gives the Bihar Student Credit Card loan and how is it decided?

Banks are allocated automatically through the DRCC after document verification. Students do not choose the bank manually; the allocation depends on district-level availability and processing load.

Q3. Is the Bihar Student Credit Card interest-free for girls?

Girls, transgender applicants, and several special-category students often receive very low or zero effective interest because the government provides an interest subsidy. This makes education more affordable and reduces repayment pressure.

Q4. When do I have to start repayment under the BSCC scheme?

Repayment begins after the completion of the course, followed by a grace (moratorium) period. EMI repayment is flexible and may extend up to 15 years, ensuring that students can start paying back only when they are financially stable.

Q5. Can I get the Bihar Student Credit Card if I study outside Bihar?

Yes, many colleges outside Bihar are eligible under the Bihar Student Credit Card scheme — but only if they are officially approved.

Always cross-check the latest eligible college list or confirm directly from DRCC before taking admission.

Q6. What documents do I need to upload for the Bihar Student Credit Card scheme 2025?

You need to upload:

Aadhaar card, 10th & 12th marksheets, admission letter, domicile certificate, income certificate, college fee structure, bank passbook, and passport-size photos. All documents must be clear and valid to avoid delays.

Q7. Can I use the Bihar Student Credit Card for private medical college fees in Bihar?

Yes, BSCC can be used to pay MBBS, BDS, and nursing fees in approved private medical colleges in Bihar, up to the ₹4 lakh loan limit. It is widely used by medical aspirants.

Q8. Is the BSCC scheme helpful for MBBS and nursing students?

Absolutely. Many students use the scheme for MBBS, BDS, Nursing (GNM, ANM, B.Sc Nursing), and paramedical courses. BSCC significantly reduces the financial burden for medical and healthcare education.

Choosing the right guidance is just as important as choosing the right college. CareerMarg has become one of the most trusted platforms for students across Bihar, especially for those applying under the Bihar Student Credit Card (BSCC) Scheme. Our team ensures that every student receives accurate information, proper documentation support, and personalised counselling throughout the entire process.

Our Office Location (Visit for Personalised Support)

CareerMarg Pvt. Ltd.

2nd Floor, Narayan Complex, West Boring Canal Road,

Beside RBL Bank, Anandpuri, Patna, Bihar 800001

Students can visit our office anytime for personalised BSCC counselling, document support, and college guidance.

The Bihar Student Credit Card (BSCC) scheme is updated periodically by the Government of Bihar. Loan amount, eligibility rules, interest subsidy, approved course list and DRCC guidelines may change based on the latest notifications.

Students should always cross-check details with:

CareerMarg provides guidance based on the most recent available information, but the final authority lies with the government.

In today’s competitive environment, the Bihar Student Credit Card Scheme is a valuable opportunity for students to pursue higher education without financial stress. With proper documentation and expert guidance, securing the BSCC loan becomes simple and hassle-free.

If you need expert BSCC guidance, document support, college selection advice, or help completing your BSCC application, the CareerMarg counselling team in Patna is always ready to support you at every step.

No Comments Found

Choosing to study medicine abroad is a major decision. For many Indian students who do not secure a government MBBS seat in India, Bangladesh has emerged as one of the most practical and academically aligned destinations.This detailed 2026 guide explains....

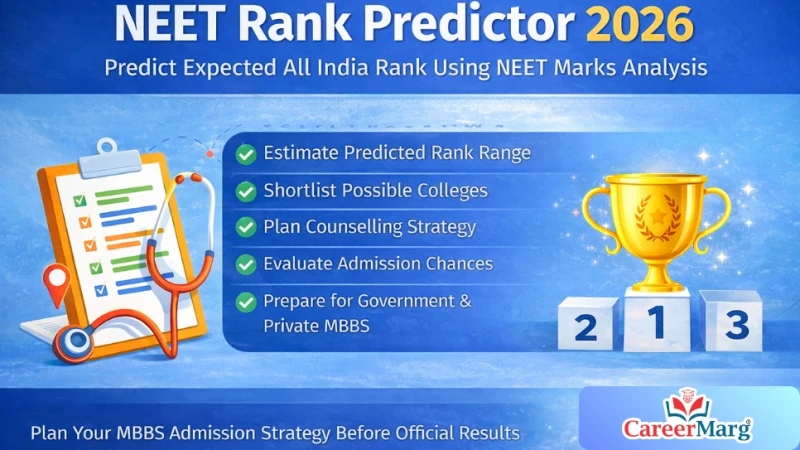

The NEET Rank Predictor 2026 helps students estimate their expected All India Rank (AIR) based on NEET marks using previous year rank trends, competition level analysis, and score distribution patterns. This prediction allows medical aspirants to understand admission chances, shortlist colleges....

The NEET College Predictor 2026 is an advanced tool designed to help medical aspirants estimate their chances of getting admission into MBBS colleges across India based on their NEET rank, score, category, and counselling quota. By analyzing previous years’ closing ranks....

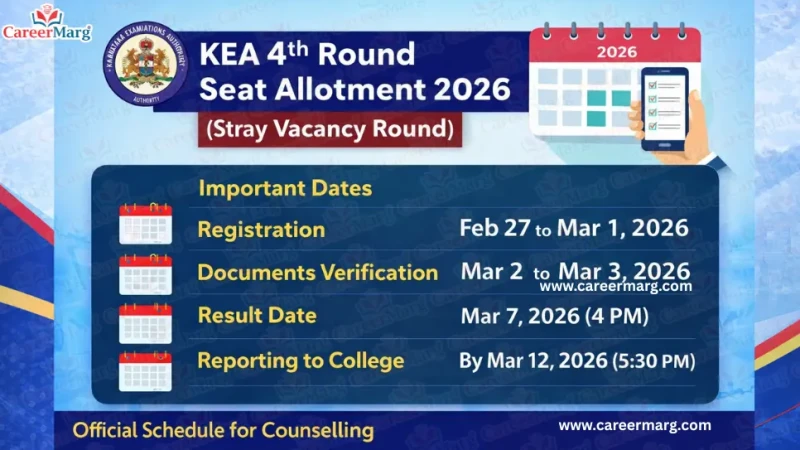

The Karnataka Examinations Authority (KEA) has officially released the 4th Round Seat Allotment Schedule 2026, also known as the Stray Vacancy Round, for candidates seeking admission into professional courses such as MBBS, BDS, engineering, and other programs.This round is conducted....

MBBS abroad for Indian students has become one of the most popular options for medical education due to limited government seats and high private college fees in India. Every year, thousands of Indian students choose to study MBBS in countries....